Disclaimer:

This blog is for entertainment purposes and should not be taken as investment advice. Consult an investment professional before making investment decisions. I do not hold any certifications or licenses that allow me to give such advice. Secondly, here at alexnoonan.com we believe suckers get what they deserve. If you make a trade or invest without doing your own research and risk management and lose you have no one to blame but yourself.

Asset allocation is overwhelmingly (~90%) the most important determinant of return outcomes. However, there is no all weather asset allocation that performs well during different market regimes. Conventional portfolio management is basically splitting allocation between defensive and offensive assets. There is different variations of this: the Talmud Portfolio (1/3 Business, 1/3 Real Estate, 1/3 Cash and debt instruments), the classic Boomer 60/40 (stock/bonds), risk parity (levered uncorrelated assets), and more unconventional methods like Artemis’s Dragon Portfolio. The critical insight from the Dragon Portfolio is that what asset allocation that has worked best in recent history would have significantly under-performed or blown up during historical periods in the more distant past.

I’m going to breakdown the different asset allocations that I target in managing my own portfolio. My barbell does not seek to plan for a retirement whether early or otherwise. I’ve done enough nothing in my life to know that retirement as it exists in it’s current form is not something I want. Rather I am allocating for purchase power protection and cash-flow to cover expenses so I can support my own projects. My target asset allocation is as follows:

- Cash – 5%

- Bonds – 5%

- Dividend Stocks – 20%

- Real Assets – 10%

- Business – 30%

- Real Estate – 25%

- Derivatives – 5%

Defense

Having money is everything not having it is. Those of us who have had sleep for dinner, had bills pile up, and have lost a job knows how suffocating it feels to live on the edge financially. Anyone who has been able fight there way out that hole will tell you how awful it is. It is something you’ll never forget. Savings and wealth broadly function to insure ourselves against such privation and misery. That’s why once one has some, it’s imperative to not throw it away.

Cash (3 months of expenses or 5%)

Cash provides an option on opportunity, the only price you pay is in opportunity cost. Personally I like to maintain a emergency cash buffer of 3 months worth of expenses. I suppose if you wanted to squeeze a little bit of yield out of cash without sacrificing liquidity you could put your cash in an online savings account or a money market fund. With Cash being a break in case of emergency asset I don’t believe in basing allocation decisions based on a relative percentage but as a total dollar amount.

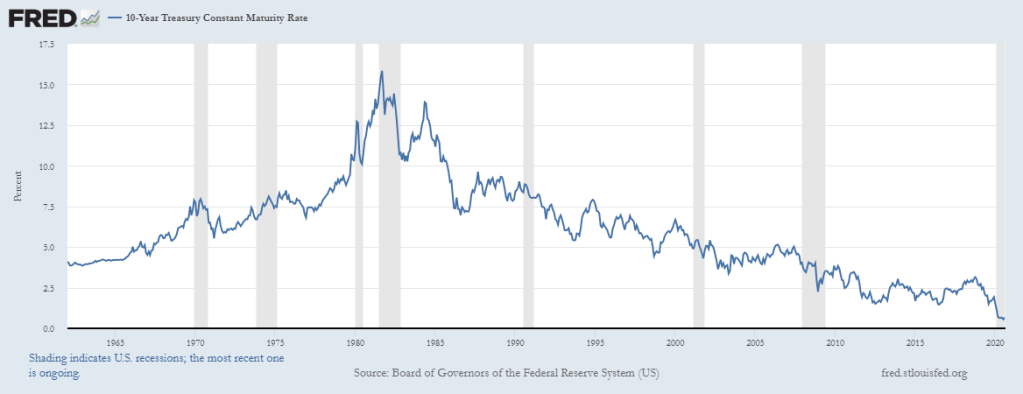

Bonds (5%)

Sovereign Bonds have worked well in the past as portfolio diversification tool. Since the 1990’s the Federal Reserve has reacted to economic downturns by cutting interest rates. This forces bond price upward and offers some positive returns during bear markets. What if the interest rate on the 10yr Treasury is practically 0? You are certainly making no money from the coupon and there isn’t much room for price appreciation. Nominal negative interest rates on government debt are a fact of life now. So the probability of negative rates in the US is something to be considered. So we must look elsewhere for yield as well as our positive convexity during bear markets.

Dividend Stocks (15%)

With government bonds yielding 0% and as an individual with no regulatory constraints there is no reason to own corporate bonds. We must get our yield elsewhere. Consumer Staples stocks such as General Mills, Procter & Gamble, and Coca-cola and oligopolies like Verizon, and Utilities provide stable dividends that are much better than bonds while also providing some tracking to the overall market. These companies being equities are certainly susceptible to the business cycle and will have drawdowns. Lawrence Hamtil’s research shows that consumer staples stocks have the second best Sharpe ratio next to healthcare and are generally an understated sector. I prefer that risk over buying government bonds that yield nothing and are extremely vulnerable to inflation and currency depreciation risk.

Real Assets (10%)

Protection of purchasing power requires owning real assets. That can be anything from Gold, gems, watches, art, or any other collectible that holds its value over time. I already wrote about gold so you can reference that post for more on that. This collection can be its own end as it may give you personally more pleasure than it’s monetary value. I plan on starting a wine collection, because wine seems to hold its value well over time. Also, I like to stay liquid and wine’s payoff is pretty good.

Offense

Business (30%)

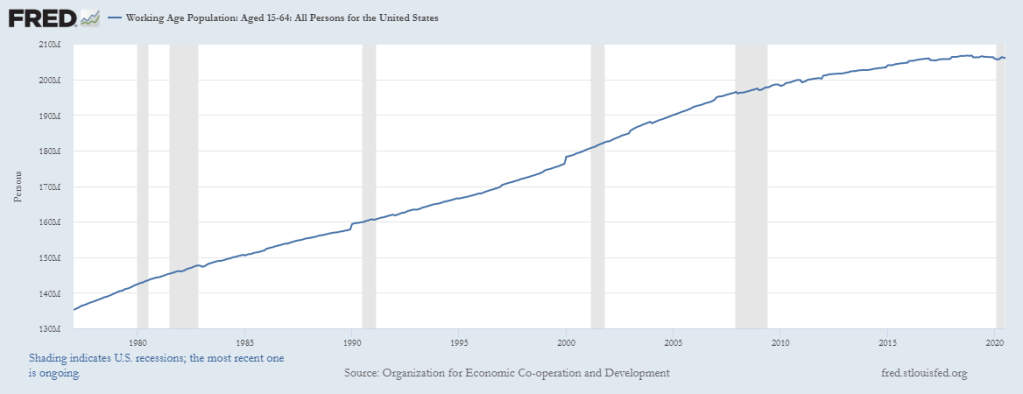

When I wrote about the FIRE movement, it’s inherent issues with trying to get rich through public equities and my plan to start my own business instead. Sure people have done it in the past, but it is unlikely the optimal conditions of the past 40 years will continue. See below images (Duration tailwind lagging, poor demographics, and stalling corporate profits)

Equity should have positive asymmetric payoff. See call option payoff diagram. If you are high enough up in the corporate structure you’ll be able to get stocks for $0 cost basis from stock options or restricted stock units. The rest of us need to start our own business to get that $0 cost basis. Public stocks are still a crucial part of my portfolio but to rely on them entirely is to be in a position where you will be trading your time for money.

Real Estate (25%)

To the people that say buy land, they ain’t making any more of it I got two things to say: Volcanoes and Mars Colony. The Real Estate sector is full of people that make obvious pronouncements and don’t seem to be particularly that smart. This is a good thing. To be successful in Real Estate you really just need to follow the established playbook and not overextend yourself. One bad deal can ruin you due to the inherent leverage involved but due to the tax advantages and the ability for small operators to successfully operate. Good luck trying to start an internet based business in the age of monopolies.

The playbook is as follows:

- Buy Property at acceptable valuation

- Make improvements to increase cash-flow

- Depreciate costs, take advantage of tax breaks, incorporate property as separate legal entity.

- Refinance property at higher valuation and/or lower interest rate to extract value of property tax-free.

- Never sell

Now these all require some work, and this is not a passive investment process. You’re going to have to do some work, especially if you are planning on doing some remodeling yourself. Choose wisely what you outsource, as you may not get quality work and it impacts your returns.

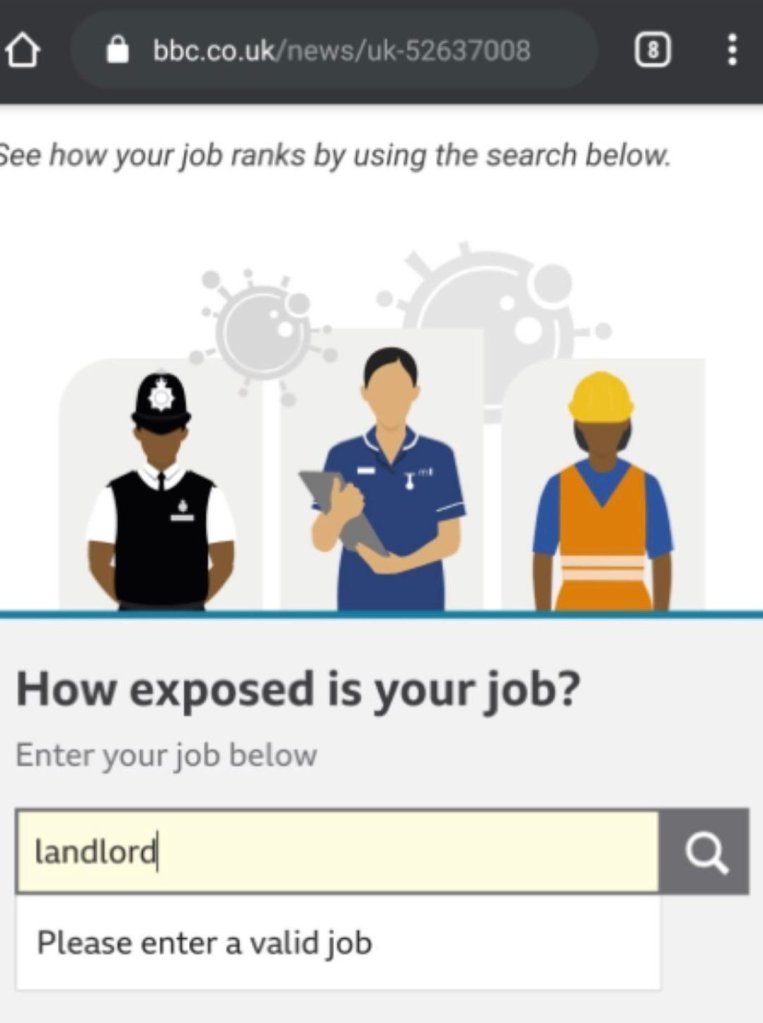

Everyone hates landlords. One of my favorite anecdotes showing this is that in the early Chinese Communist movement Mao Zedong analyzed that the hatred for Landlords ran so deep in the Chinese countryside that it could be used as the basis for a strategy of mobilizing peasants for the Revolution. This turned out to be an astute observation and proved to be more effective than the strategy at the time of appealing to intellectuals in the cities.

How can you not hate them? Literal rentseekers that don’t provide any value and expect to be shielded from risk when it moves against them. I believe the way to mitigate this risk is simple: keep scale small and don’t be an asshole. The problem that comes with scale is that as you have more tenants, it is necessary to standardize processes and procedures. So your ability to handle situations on a case-by-case basis and by extension forces you to make cruel decisions. If you manage your risk correctly and plan for times of reduced or no cash-flow this also gives you more latitude to not be cruel. The main point here is to not be a full time landlord but to get a real job.

A Little of Both: Derivatives (5%)

)There are not more than five cardinal tastes (sour, acrid, salt, sweet, bitter), yet combinations of them yield more flavors than can ever be tasted. In battle, there are not more than two methods of attack: the direct and the indirect; yet these two in combination give rise to an endless series of maneuvers.

Sun Tzu “The Art of War” Ch 5.10

My favorite quote from the Art of War is this passage about indirect and direct methods. Like in cooking, few factors provide endless possibilities. In investing the same principle applies. For the analogy to hold, being outright long or short something is to be “direct” and using derivatives is to have “indirect” exposure. Derivatives can be either defensive or offensive. They allow you to gain exposure abstract financial concepts like volatile and trend while at the same time managing risk. Options contracts are my derivative of choice due to their non-recourse leverage.

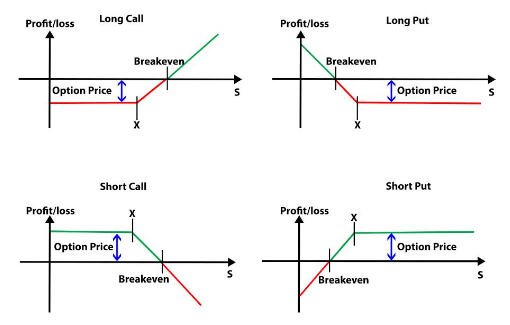

Options are pretty complicated relative to stocks or bonds there is a steep learning curve of vocabulary and concepts that need to be understood . Fortunately there are plenty of YouTube explainers and books that you can use to learn the basics. I am not going to explain them fully here but below I put the payoff diagrams for the basic contracts. Before you trade options you should understand what the various Greeks are (theta, vega, gamma, delta) and how a spread is long or short all of these factors. I learned by just watching YouTube videos and reading research reports. The material is abstract but just like when you stare into the ocean and start having a deeper understanding of life, Options will come to you.

By learning more about options you will in turn have a greater understanding of how markets function. You can determine a stocks expected range from its implied volatility and also assign a probability to a move. Concepts like dynamic hedging more or less provides some efficacy of some technical analysis techniques. Since Black-Scholes pricing models are based on probabilities you begin to look at trades and investments from a probabilistic framework (the right way) as opposed to a deterministic framework.

I have trouble with being too active and letting my winners do what they are supposed to do. To address this behavioral shortfall, I trade options as opportunities present themselves. Additionally, since options are zero-sum and risky, they are a correspondingly small part of my total portfolio. I also didn’t start trading options until I had enough active capital to do so (>$10,000).

One response to “The Barbell Portfolio”

[…] of instability will not work as well as they have before. I have previously wrote my views on asset allocation. The bond market vigilantes may return in our hour of need to restore the honor of American debt. […]

LikeLike