Disclaimer:

This blog is for entertainment purposes and should not be taken as investment advice. Consult an investment professional before making investment decisions. I do not hold any certifications or licenses that allow me to give such advice. Secondly, here at alexnoonan.com we believe suckers get what they deserve. If you make a trade or invest without doing your own research and risk management and lose you have no one to blame but yourself.

Gold attracts weirdos like months to a flame. You got the doomers, Fed truthers, inflationistas, Austrian economists, boomers that watch too much Fox News all proclaiming the end of world due to the amount of Government Debt. You also have investors/traders looking for some uncorrelated assets. But simply put Gold is nature’s Bitcoin. Warren Buffet, the patron saint of investors who cant think for themselves doesn’t invest in precious metals and would rather invest in “American Mettle” (Cringe).

Gold has a place in portfolios as a defensive asset to increase risk-adjusted returns. Full disclosure: I personally have it as one of my largest core positions. Gold not only protects purchasing power in the long-term, during periods of higher than expected inflation or financial repression it really catches a bid.

Supply

Mining being an industrial process is extremely capital and energy intensive. Gold mining is the same way. As with any business that does not have control over the input price or the finished good price their industry cycle is more tumultuous. So it doesn’t make sense try and have these companies compound within a portfolio but instead catch the significant trends up or down.

Unlike back in the day where people could pan for gold flakes in streams and rivers. Today it is primarily extracted through a heavily industrialized mining process. For the large deposits it can be taken out of the ore directly. The gold is usually bonded to other metals like copper and silver. It is then extracted by dissolving the surrounding rock and removing the bonds to the other metals through cyanidation. Since gold cannot be created artificially in an economic fashion to the disappointment of the alchemists. We gotta pull it out of the ground.

These mining companies performance correlates with the price of gold. Since these businesses require a lot of debt, and gold performs well when real rates are low or negative this creates a positive feedback loop for the businesses and provides positive asymmetry. Also, as one would imagine with an industry about producing gold, this space has it’s fair share of fraud so there’s no need to go too deep into the weeds and try and find the perfect company. Getting broad exposure to the sector when the macroeconomic conditions are right is sufficient. That’s why I like the GDX etf, to get positive exposure to a defensive asset.

As you can see the GDX has returned 234% over the past five years. Which ain’t to bad. This sector still has room to run provided energy prices stay low and more importantly the fundamentals for Gold price stay strong.

Demand

Gold wouldn’t be the worlds favorite metal if it wasn’t scarce. Gold’s demand can be broken into jewelry, electronic components, other industrial uses, investors, and monetary demand. Jewelry and technological uses comprise on average 60% of annual demand with investment and central banking compromising the rest. I’m going to focus primarily on investors.

For investors Gold behaves as an infinite duration zero coupon bond with a slightly negative carry due to storage costs. For those that are unfamiliar with futures pricing I broke down the calculation for pricing here.

Duration is one of the foundational concepts in finance. Its calculation is basically the weighted average of when the future the cash-flows of an investment are. The 30 year treasury bond will have a longer duration than a 1 year treasury bond. Also, growth stocks will have longer duration than value stocks as the cash flows are supposed to be larger in the future due to the growth (and leverage).

Since gold has no cash-flows and only generate when you sell it. The only time it makes sense to know it is when the long duration “risk-free” real rate is negative. The deeper the negative rate, the greater the relative protection gold provides over bonds. During the 1970’s when inflation was raging, government bonds were considered certificates of confiscation it made much more sense to own Gold. Gold will also perform well during periods of financial repression, which is when the government controls where capital can go. The last time this was the case in the United States was in the 1940’s when Federal Reserve enacted Yield Curve control and there were other price controls in the economy. They ultimately let the economy run hot to inflate the war debt away by forcing institutions to buy government bonds that soon lost their pricing power.

The question with any investment is who is the incremental buyer. The Gold Industry is peanuts compared to the Bond or Stock Market and is currently beneath the threshold for institutional investors to allocate capital too. However, if the Gold and Gold Miners bull market continues and the big money comes in and increases their allocation from 0.5% to 2% there could be major upside still for the pet rock.

Short History of the Gold Standard

Currencies are based on confidence more than anything else. Establishing credibility can be done in several ways: gold in a vault, pricing of commodities, and requiring taxes to be paid. Gold in the vault is the least abstract system and it’s what the global monetary system was based on prior to World War I, and then was reinstated after World War II, and finally broke after Nixon suspended the gold convertibility in 1971.

Prior to World War I was the classic era for the Gold Standard. Banks would issue money that was backed by the amount of gold held in their vaults. The money supply could expand or contract by manipulating reserve requirements. But there had to be gold physically there to back the money. Balance of Payments accounting had direct impact on gold reserves. A capital account deficit from one country to another would require gold to be moved to the other country’s banking system. In order to avoid having to sail it around, Central Banks held Gold reserves for other Central Banks. So you’d have guys in the basement moving stacks of gold from the Britain corner to the French corner.

World War I can be described as every industrial power pushing thier societies to the brink. At the outbreak of the war a member of the British Cabinet said based off the Gold supply and the cost of War it could only last 6 months. The convertibility of gold was quickly suspended and governments borrowed (mostly from the United States) whatever it took to try to win.

The war reached a certain point where the stakes were either victory or complete collapse of society like the Soviet Union. Four Empires (Russian, German, Austria-Hungary, and the Ottomans) collapsed as a result of the war. The Gold standard could not continue after Versailles. The Allies owed so much debt to the United States that there was no way they would be able to pay it back unless they extracted some cash from the losers. But Germany had just lost 1/4 of thier territory and at the end of the war was melting down church bells for ammunition couldn’t pay. Additionally, the United States had 3/4 of the world’s gold supply which caused the system to be significantly out of balance.

This fight over war reparations, gold reserves, and currency exchange rates. Would lead directly to the Great Depression. Great Britain would put itself through a period of painful deflation by trying to bring the Pound back to the pre-War exchange rate. Germany destroyed thier middle class by printing the Mark till it was worthless. France managed to thread the needle and only due a little currency devaluation and was in a much better financial situation than it’s neighbors despite destruction it experienced during the War.

The Depression led to World War II as these things tend to do. In 1944, when it was clear there would be an allied victory the Bretton Woods conference was convened, which would establish a global currency regime for the post-war world. Since the United States was the preeminent economic power coming out of the war they maneuvered to make the Dollar the basis for monetary system with it being convertible to gold and all other currencies being exchangeable to dollars. This cemented the Dollar as the Global reserve currency. A gold standard isn’t ideal from a government perspective since they have to somewhat balance the budget. Congressmen and defense contractors would starve.

The new gold standard worked until the United States went on a spending binge in the 60s on the Vietnam War and expanding the welfare state. So in 1971, instead of raising taxes or cutting spending Nixon temporarily suspended the convertibility to gold and that was the end of that Gold standard.

If you’re interested in this subject and want more depth on the economic conditions that led to the Great Depression and WWII check out these books.

Is Gold Money?

Gold is Money, everything else is credit

JP Morgan

My favorite gold stat: An ounce of gold could purchase a month of labor during the Roman Empire, Victorian Britain, and Today. There isn’t any other currency that even comes close to that long of a track record. As we all know, a currencies must perform the following functions:

- Medium of exchange

- Store of value

- Unit of account

You would have a tough time buying something at the store with Gold. In terms of valuation it only matters how many Dollars, Euros, or Yen you can “buy” with an oz of gold. I wouldn’t classify gold as a currency, it is more of a neutral reserve asset.

When looking at the S&P 500 priced in gold ounces you can see a few things. First, gold preserves its ability to buy US equities over time and that there are times when it makes sense to convert your gold into stocks and visa versa. And that If you hold gold for the long-term you wont see much growth. So gold is good to have in a portfolio but it isn’t everything.

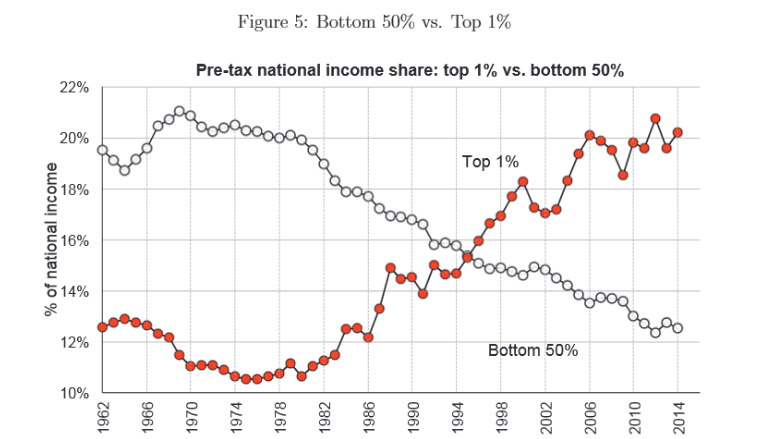

Second, if you are in the inflationista school of thought (see shadowstats) you can infer that there hasn’t been any real growth in the United States and what growth we have seen is just from financialization and wealth transfer to the wealthy.

We all have see some variation of a chart showing the degree of wealth and income inequality in the United States. The ending of the Gold Standard in 1971 is not the only reason this trend happening, but it didn’t help.

In closing the Gold bugs and perma-bears like Peter Schiff are broken clocks that are right once every fifteen years. Gold does a good job of preserving wealth and allocating to it tactically can provide superior risk-adjusted returns during periods of currency debasement and inflation. But rotating your purchasing power from Gold back into growth assets is equally important.

One response to “The Basics on Investing in Gold”

[…] other collectible that holds its value over time. I already wrote about gold so you can reference that post for more on that. This collection can be its own end as it may give you personally more pleasure […]

LikeLike