Disclaimer:

This blog is for entertainment purposes and should not be taken as investment advice. Consult an investment professional before making investment decisions. I do not hold any certifications or licenses that allow me to give such advice. Secondly, here at alexnoonan.com we believe suckers get what they deserve. If you make a trade or invest without doing your own research and risk management and lose you have no one to blame but yourself.

This may shock some of you, but there are stocks out there besides large-cap U.S. Tech companies. The oil tanker industry has a long track record of destroying capital but I believe it is on the cusp of a turnaround. I first became aware of this trade after reading about it on Kuppy’s blog https://adventuresincapitalism.com/. After doing some of my own research I decided to get in on it first in October of 2019 and then in February of 2020. Below is a short summary of the research and rationale behind this trade.

Some of the specifics of business can be complex to those unfamiliar with finance. So ill explain a little about futures contracts and how they work, while I’m certainly no expert, I’m also not an idiot.

Futures

Futures contracts are standardized contracts traded on an exchange to buy or sell an asset or commodity at a point in the future. They can be used as a speculative instrument and can be quite lucrative (leverage). Most of the time they are used to hedge risk of commodity price volatility as you can lock in a price now for later. For example, McDonald’s makes a lot of McChickens. They want to keep the McChickens on the dollar menu and maintain a profit but the price of chickenfeed (corn) fluctuates constantly. They use futures to buy corn for later delivery at a favorable price and the farmers on the other side benefit as they know they have someone to sell their product to.

Like most things in finance commodity futures contracts have a term structure. Term structures show the different price that a financial instrument has depending the maturity. You may have heard talking heads on CNBC yammering about the yield curve, contango and backwardation. These all refer to term structure, with the yield curve referring to treasury bonds and contango and backwardation referring to the shape of term structures. Futures prices do not try to predict the future. They rather reflect what the future price of something would be based on some underlying assumptions.

Below is the basic equation for how futures prices are calculated.

F0 = S0e(r-q+u-y)T

- S0 = current spot price

- r = risk free rate

- u = storage costs

- q = income

- y = convenience yield

Storage costs and interest rates makes holding the underlying asset more costly and increase futures price whereas income and convenience yield makes holding the underlying more attractive and decrease the futures price. These directly affect the shape of the term structure. Finally, the supply and demand of the marketplace are what determines what the prices of the contracts.

Tankers

Oil tankers are an extremely capital intensive business with high fixed costs. The drivers of profitability for these businesses are based on two forces: supply/demand of ships and tanker charter rates/fleet utilization. But like anything else, shipping follows a cycle. They have been in the down part of the cycle for awhile now. However, there is good reason to believe that we are at the inflection point for a turnaround in the cycle.

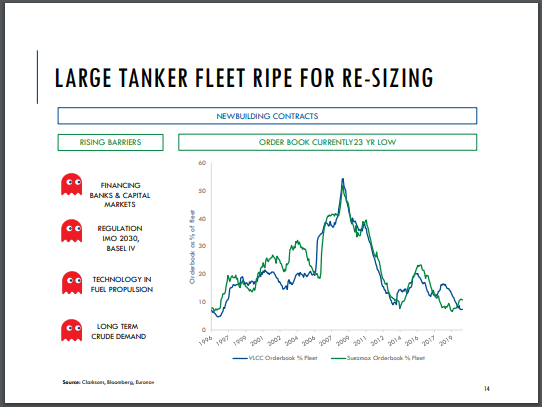

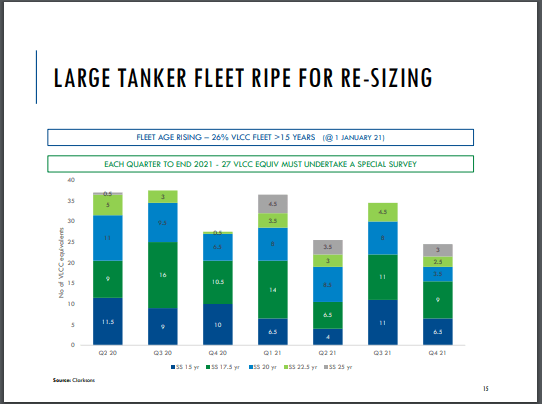

Fleet Supply & Demand

Below are two slides from the Euronav earnings on 5/6/2020, they show the current state of VLCC tanker (Big ass ships) fleet. When you look at the number of ships that are 15 years or older and look at the orderbook for new ships it is pretty clear that there will be a net negative in fleet growth. Additionally, the IMO 2020 regulation that was made effective Jan 1, 2020 requires ships to install scrubbers or use low-sulfur fuel. Installing a scrubber on a vessel is expensive and operating older vessels with low-sulfur fuel can be more expensive than retiring an older vessel. Finally, as the era of free trade seems to be coming to a end it is reasonable to expect that as restrictions increase the amount of different trade routes also increase. These effects acting together should be bullish for tanker rates in the intermediate term.

Floating Storage

The economic crisis we are facing right now is really three related crisis’s rolled up into one. First demand collapsed after government response to the pandemic. Then overlevered corporations were at risk of default. To top it all off a price war was started in the oil market by Saudi Arabia and Russia to crush U.S. shale. How is any of this bullish for tankers? The oil market was oversupplied going into this thing and when SA started pumping it only made it worse and storage became an issue. The saying goes that cheapest place to store oil is in the ground. But once the land storage gets scarce, people get creative.

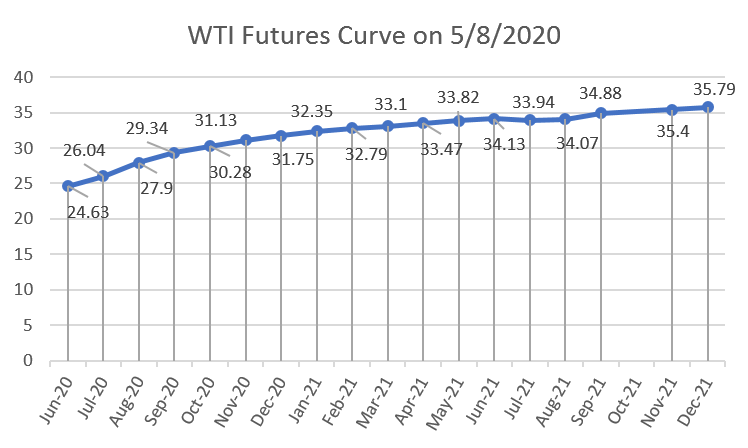

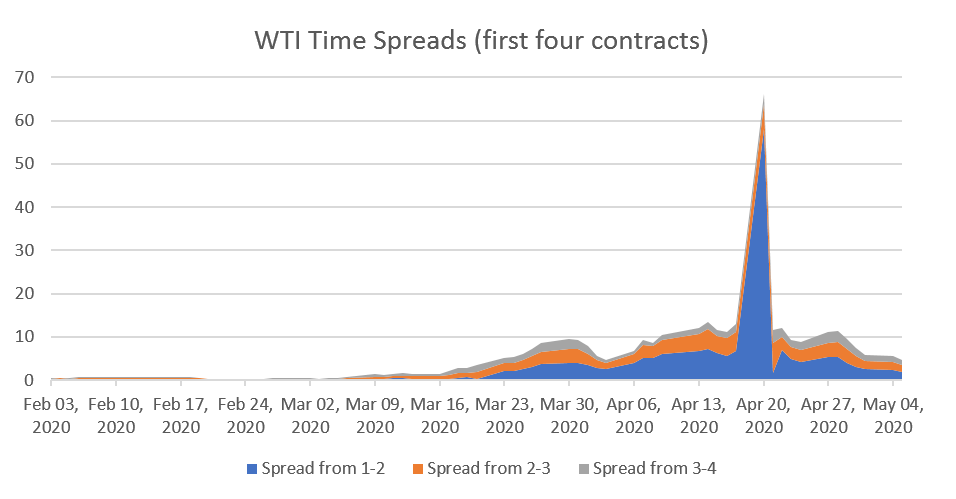

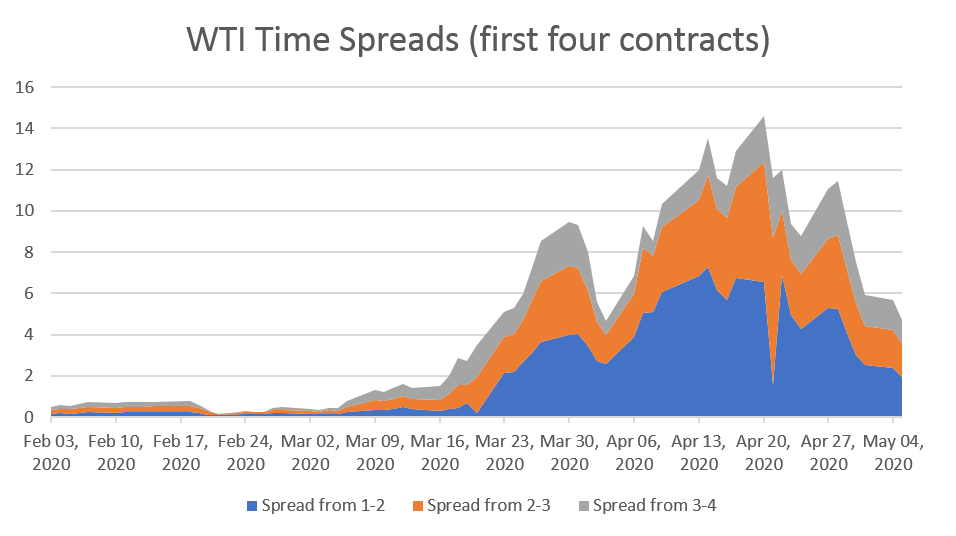

The current term structure for the West Texas Intermediate contract is currently in contango. Below is the futures curve as on 5/8/2020. In order to see how the shape of the term structure changes over time I’ve charted the difference between the different contracts since January.

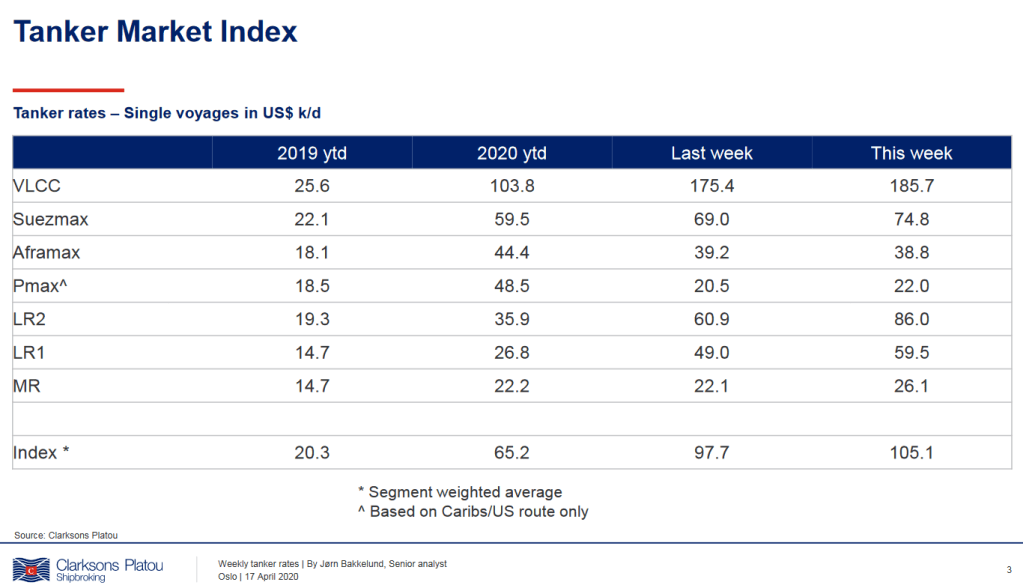

The charts above show that the significant degree of contango in the front end of the oil market. This is mostly a reflection of the tight storage conditions. Some operators have been buying oil at the spot price which is absurdly cheap, chartering a tanker for six months and then selling an futures contract for 6 months later at a higher price and locking in the profit. This need for floating storage has caused tanker charter rates to explode. The charts show that the spreads have tightened from the peak in mid-April due to production cuts and tanker rates have declined correspondingly. However, As long as the spread stays elevated relative to historical averages, Tanker companies should be able to bank the elevated charter rates. (See Below)

This trade is a way better way to play the oil oversupply situation on a risk/reward basis than trying to trade futures or through the USO ETF. Oil is a notoriously difficult commodity to trade and is best left to the pros. Side note: anyone that buys USO deserves to lose all their money.

Risks

The greatest risk that this trade presents is that the contango in the oil market unwinds quickly and these companies don’t get to print money like it’s going out of style. This situation would require the coronavirus to resolve itself and oil demand to pick up so the excess supply can be quickly unwound. This would be great news! To me it seems overly optimistic considering the 23 million unemployed and the fact that starting the economy back up after a full stop will certainly involve some stutter steps. But the biggest risk are that these are tanker companies which notoriously destroy capital. Key things that I will be watching in the short term are: 1. The oil futures term structure, 2. Tanker charter rates.

Positioning

If this trade works out it will resemble a call options payoff. These asymmetric bets don’t come along all the time. I am not using leverage or options on this trade. The embedded operational leverage in these companies is good enough. Having a basket of a few of these companies is important to get exposure to the different segments (VLCC & product tankers). I am also keeping position size to <3% of my portfolio since these stocks have a lot of volatility and I’d like to sleep at night and if it all blows up I will check myself into Bagholders anonymous.

Let me know If I am way off or if you have some feedback. Please share If you enjoyed what you read!

One response to “Trade Idea: Long Tankers”

[…] For investors Gold behaves as an infinite duration zero coupon bond with a slightly negative carry due to storage costs. For those that are unfamiliar with futures pricing I broke down the calculation for pricing here. […]

LikeLike