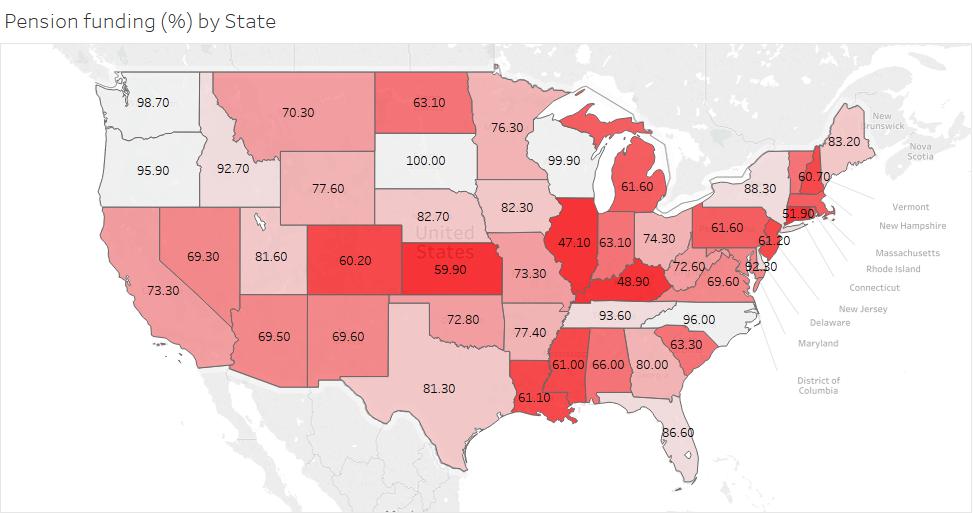

The above picture shows the funding percentage of our Nation’s public pensions. not a pretty picture. As if our country needed another complex divisive issue to tear us apart. This is a financial crisis that could have a greater impact on the country relative the student debt “crisis”. Yet it is largely ignored by the public. It will pit the tax base of a state (property owners, high-income owners, business owners) against public sector employees who are facing retirement in poverty.

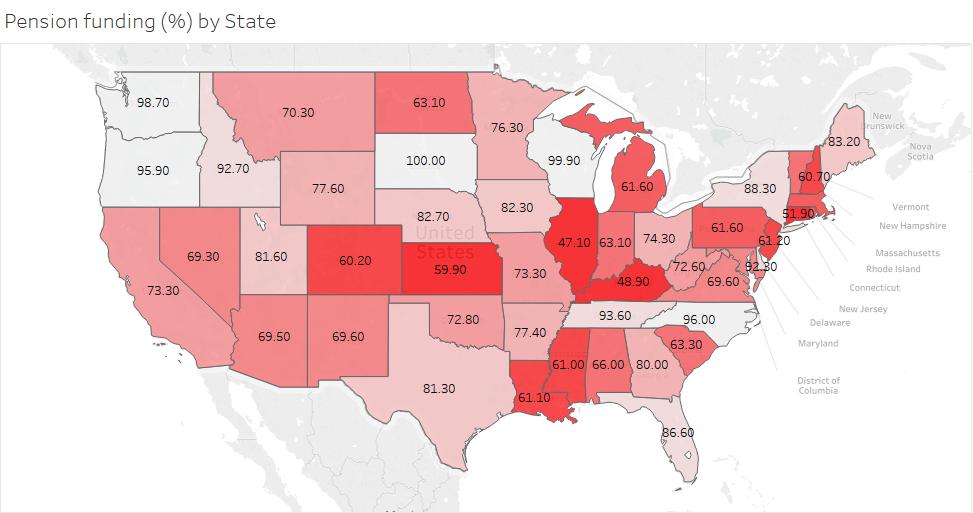

Demographics are important for investors to understand because humans are the root of all economic activity. In both productivity and consumption you can see that people follow similar arcs across their life. Older people tend to spend less than their younger counterparts. which makes sense since they are living conservatively to ensure they will be covered for the rest of their life.

There is a second critical point to pull from the above data. A smaller proportion of the population working means a reduction in the tax base with an increase in spending. Also, with less children being born and increased lifespans, the ratio of retirees to working people will only become more strained.

Private sector workers must take matters into their own hands. But those on the Government payroll have access to defined benefit pension plans. These plans “guarantee” those that have put in the time stable cash-flow for the rest of their lives. However, many State and Local Governments pension system’s are seriously underfunded. Here are the five States that are in the worst situations.

Five worst States (% unfunded):

- Illinois (47.1%)

- Kentucky (48.9%)

- Connecticut (51.9%)

- Alaska (52.2%)

- Kansas (59.9%)

States lack the budgetary flexibility of the Federal Government. In order to maintain fiscal balance they must either cut benefits, raise taxes, or both. These pensions are protected under the State constitution, so by some way or another the show must go on. Unfortunately no, In 2013 Detroit became the largest municipality to default on its pension obligations and bonds. The bankruptcy went up to the Federal Courts, which overrules the Michigan State Constitution and set the precedent that pension payouts are on the table for cutting.

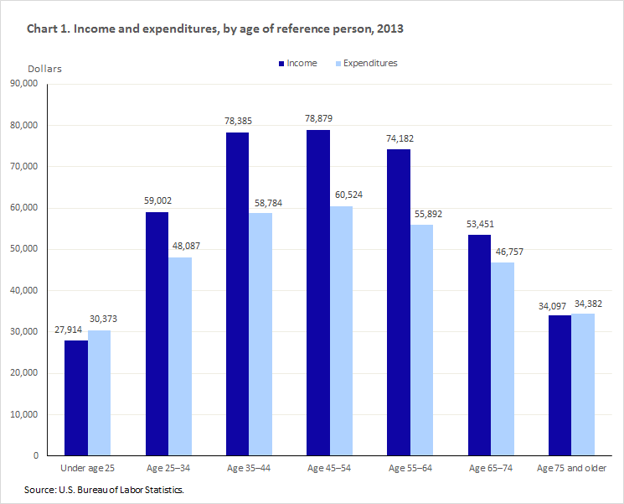

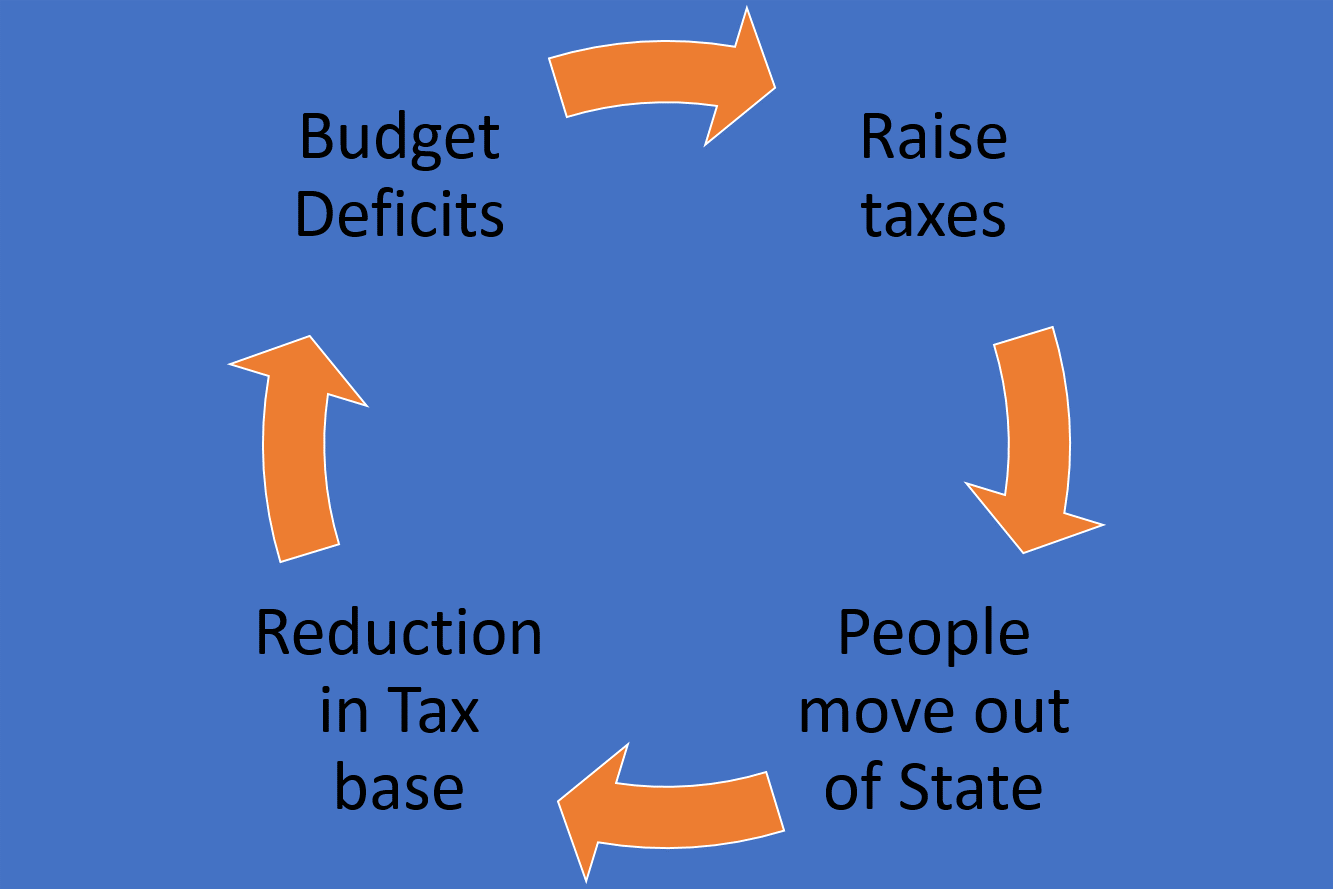

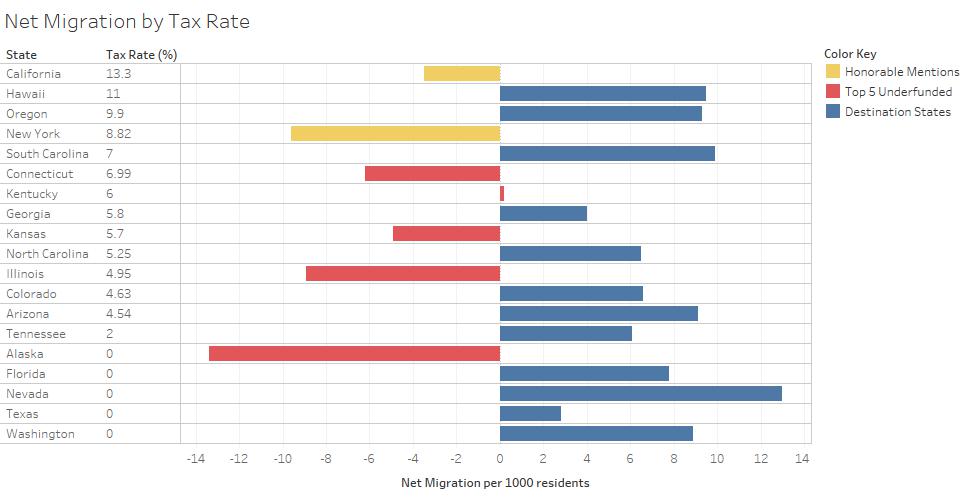

It is not as simple as raising taxes on the wealthy though. One of the benefits of being wealthy is the ability to move. While high taxes are not reason enough for people to leave. When you consider climate and the tendency for retirees to move to low tax states. It puts some states like Illinois in a precarious situation. Below is the negative feedback loop that could come from a State that raises its taxes too high.

It seems that Tax Rates are not the single greatest reason why People leave a State. But when you add other factors such as the Winter in the Northeast you can see that there is a migration trend to the Warmer Low-Tax States.

Pension Funds as considered Institutional investors, which means they are large pooled funds that are managing by teams, have return mandates, and asset allocation requirements. The 2008 financial crisis hit them particularly hard. In addition, Sovereign Bonds yields have decreased over the past 30 years with some debt yielding negative return. With Pensions being significantly underfunded and safe assets not offering necessary returns, these funds have been forced to expose themselves to riskier assets. Whenever the next recession happens, a decline in stock prices would make these pension funds in worse shape.

The Political situation that this will create will be a mess for sure. Raising taxes and cutting benefits in a downturn will only make matters worse. Additionally, if there is a Federal bailout I am expecting people from Texas and North Carolina to be furious with the prospect of bailing out Illinois and Connecticut. With our Politicians being known for their great compromises and proactive problem solving they should have this one under control.

The So What

So what’s the trade? For me it’s long Muni-bonds and long Marijuana.

Municipal bonds are another way that State and Local Governments can fund themselves. __ The Federal Reserve’s new favorite tool is quantitative easing, which it used to buy bonds during the financial crisis. As temporary emergency measures turn into permanent normal policy and all this talk about Modern Monetary Theory. If the benevolent all-knowing FED decides to bless the States with QE of buying Municipal bonds, there would most likely bring lower yields and higher prices.

As if Legalizing Marijuana needed anymore benefits. It allows States to raise taxes without raising taxes and legitimize economic activity that is happening anyway. Illinois recently made the move to legalize recreational use. I suspect during the next economic downturn there will be an increase momentum to legalize. As it is more palatable to cutting retirement benefits and raising taxes.

Whenever this situation starts to unfold I will write a follow-up post to show how well/bad my trades did.

Disclaimer

This blog is for entertainment purposed only. Nothing you see her should be considered investment advice, they are just my opinions. I have no credentials to be giving financial advice so consult a professional before making investment decisions.

Additional Resources

Frontline documentary on Kentucky’s public pensions

Also, I used Tableau to create the Pension funding (%) and the Net Migration Chart. It is a pretty cool Data Visualization Tool and makes much cleaner charts than Excel. If you are a student you can get access free for one year.