If you had to guess which stock had better performance (risk-adjusted returns) over the last ten years would it be WD-40 or Tesla?

That’s right… It’s WD-40. I bet your dad would’ve known.

“But of course, It’s the perfect product”

Now choosing 2009-2019 is cherry picking the time frame to the longest bull run in history and buying pretty much any equities during this time period would have resulted in some juicy returns. Also, using Tesla as the comparison is rather convenient. The reasoning behind choosing Tesla is due to the: poor business financials, celebrity CEO, persistent media coverage. Here’s an analysis from Real Vision on the bear and bull case for Tesla.

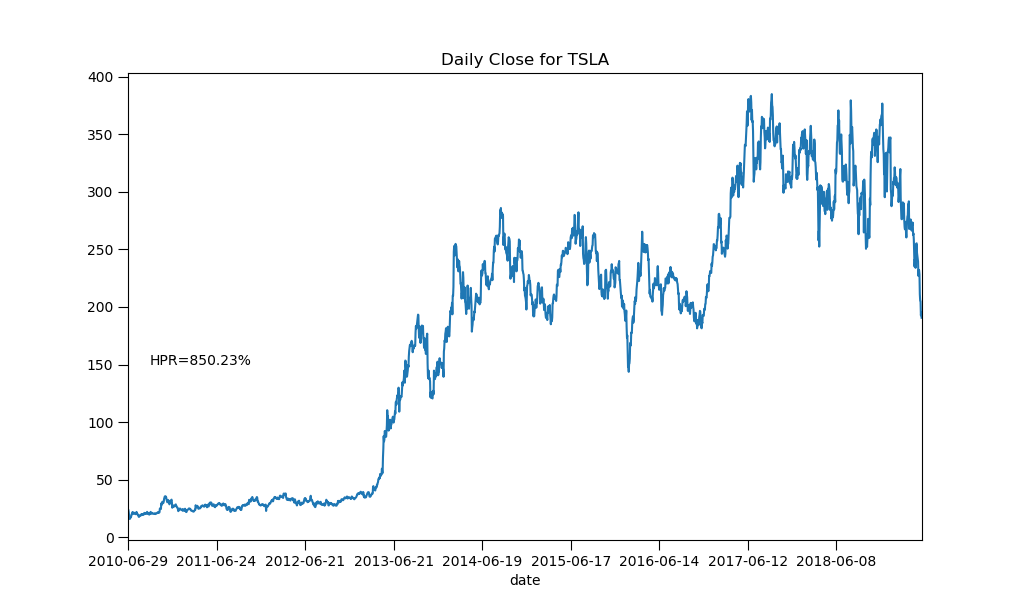

If you compare the results of holding WD-40 for the last 10 years and Tesla from IPO you will see that Tesla has a larger percentage return. But when you look at the Tesla chart you’ll see large movements up and down characteristic of a meme stock. Those large movements make it more difficult to hold the stock and actually capture those juicy returns.

I choose to invest in order to make my life better in the future and I don’t want my portfolio to stress me out along the way. Avoiding bad investments is more important than picking the good ones. For example, a -50% draw down requires +100% return to break-even. While it’s impossible to determine the next Amazon, you can avoid bag-holding the next Enron.

When I say “boring” here what I mean is a good business. If I am invested in strong companies that stay out of the news I won’t be tempted to check the stock price. Generally speaking, the more often one checks their investments the worse that person does. So any screening measure that increases my odds of staying invested should be explored.

Disclaimer

This blog is for entertainment purposes only and should not be considered investment advice. I am not a professional and are not qualified to give such advice. This site reflects my own opinions and does not reflect the positions of any institutions I am affiliated with. There will be errors and mistakes but I will make the effort to be as factual as possible. So don’t take anything here too seriously. I reserve the right to change how this blog functions and the content on it.